Use our ROI calculator to estimate the potential gain you can expect when investing into Evocon.

Value created per year (after expenses)

Profit from additional turnover (after expenses)

ROI year one

Return in days

In general, we see that clients can expect a relatively quick return on their investment into production monitoring and OEE tracking when using Evocon.

Although our calculator shows ROI on a per annum basis, the initial investment usually pays for itself within 3 months. And that’s in case your baseline OEE is at 60% and you see only growth of +2,5%.

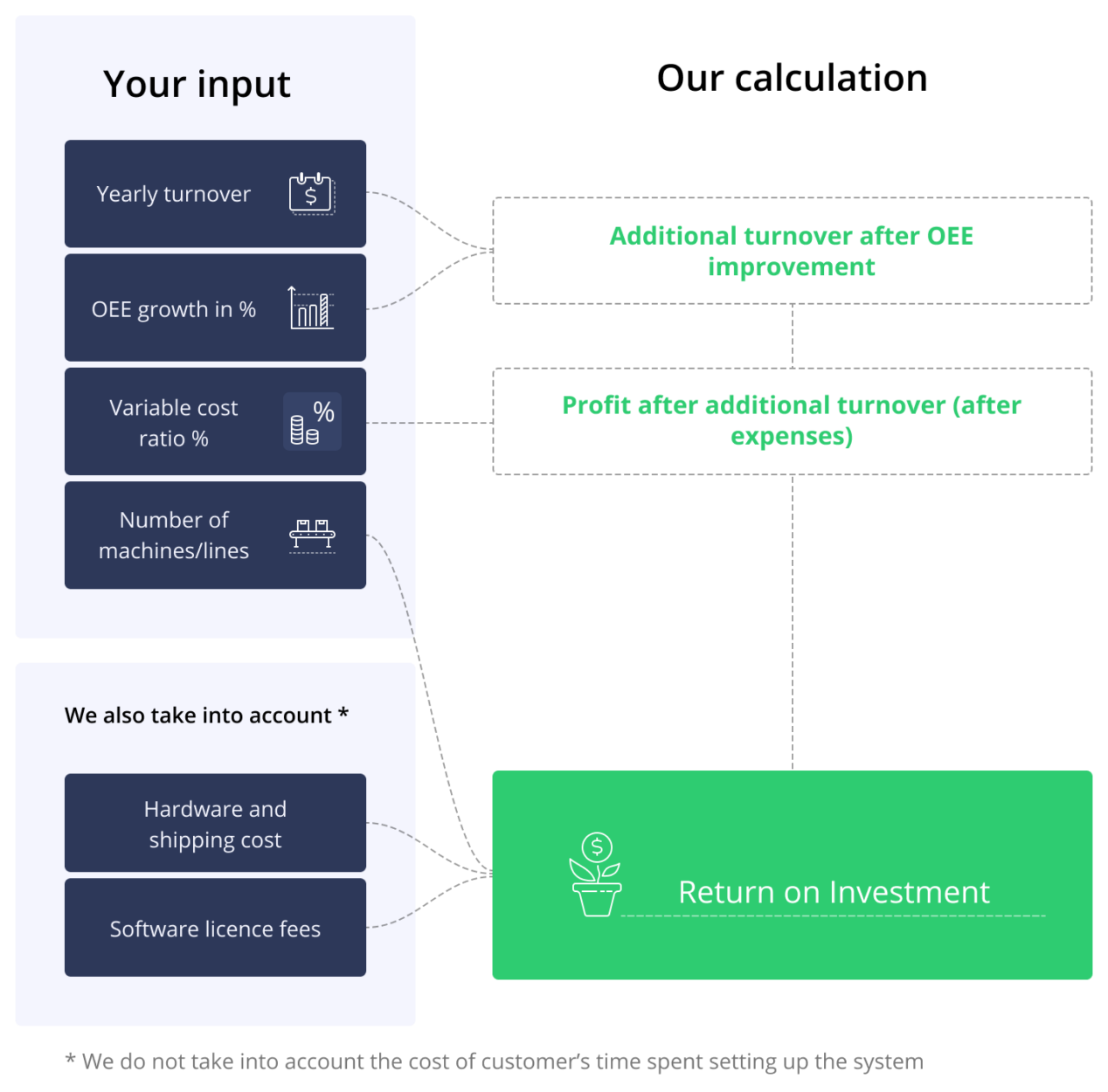

In our ROI calculator for OEE Software and production monitoring, we look at two different scenarios.

Our first scenario (optimize cost) looks at the hourly running cost of a production machine or line and is suitable for most manufacturers to use. The second scenario (maximize output) looks at a situation where you have a high-demand product and are running at your current maximum output.

From the calculator, choose the scenario that applies best to your situation and calculate the expected ROI for your company using Evocon.

If you are unsure, look at the examples for both scenarios.

The variables to enter into the calculator depend on the scenario you use to calculate ROI.

Below is an explanation of the variables in both scenarios.

Our ROI calculator for OEE software takes into account the following costs related to implementing Evocon:

The calculation also includes investment into displays (e.g. iPad or PC) that the client sources based on their specific need.

The calculation does not consider the time invested in setting Evocon up in your factory.

Note: Maintenance and support fees are included in the monthly license fee of Evocon.

Implementing Evocon as a hardware-free solution is also possible, thus eliminating all hardware-related costs and increasing your ROI.

You get different outputs depending on the scenario you use to calculate the ROI of Evocon’s OEE software.

Here is a quick explanation to understand what is behind the numbers:

ROI = Value created – Investment in OEE system / Investment in OEE system* 100

Return in days = Expenses / ((Value created per year + Expenses) / 365)

Return in days = Expenses / ((Profit from additional turnover + Expenses) / 365)

If you are unsure which scenario to use in our ROI calculator for OEE software or what values to enter, these two examples will give you an overview and help you make a choice.

In this scenario, we will look at a company that wants to optimize the hourly cost of running a production machine or line. We determine the input variables and look at how to calculate ROI based on these numbers.

In conclusion, if your OEE improves by 15% then your 2 457 EUR investment in the first year can turn into 47 475 EUR (49 932 – 2 457) of profit, which means that you achieve the same output as before by working 525,6h less during the year.

Now let’s look at a company with a high demand for its products and working at maximum output with 7 machines. In this scenario, the growth in OEE can have a higher impact than just hourly running costs or the general profit margin applied to the extra volume.

In conclusion, if OEE growth improves the output by 15% and the variable cost ratio is 55%, then in the case of 10 million EUR turnover, your 16 002 EUR investment generates an additional yearly profit of 675 000 – 16 002 = 658 998 EUR.

When we produce more with the same fixed costs (salaries, rent, insurance, etc.), we generate more profit per unit on the additional output because the fixed costs have already been offset, and every additional unit comes only with the price of variable cost.

Let’s consider your company’s alternatives if you choose not to invest in increasing OEE. In this case, your company will look at large capital investments to increase production output. These would typically include:

Thus, an investment in OEE software and production monitoring can also keep fixed costs lower.

We often see a tendency to misunderstand percentages when looking at the ROI of OEE software. This, in turn, leads to a misunderstanding in the change to the bottom line that OEE tracking and improvement brings.

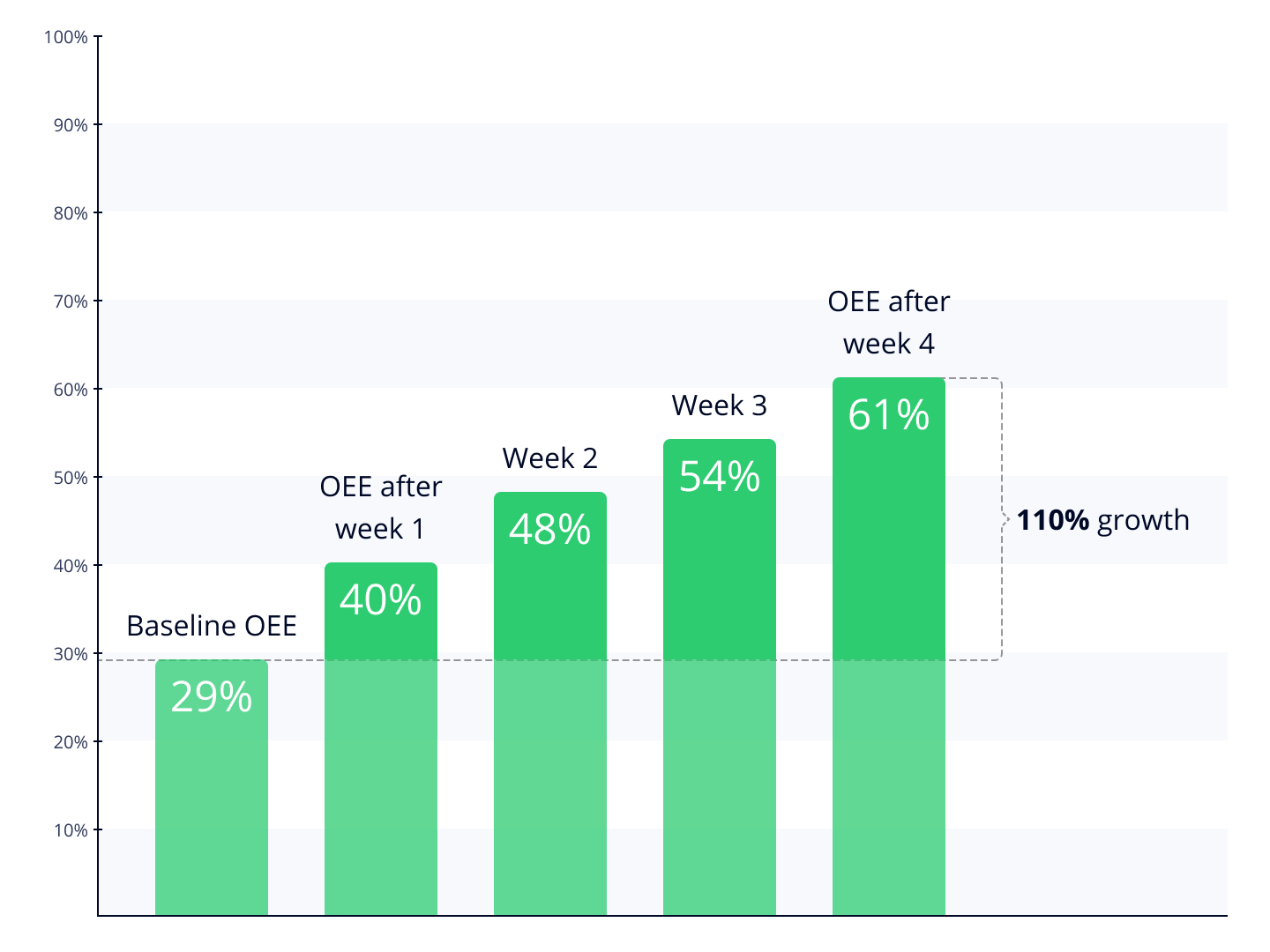

To illustrate this, let’s look at an example of OEE change week over week and what it means to the business. The data is based on one of the Evocon free trials.

In our example, the client started with a baseline OEE of 29%. At the end of Evocon’s free trial, the OEE reading for that machine was 61%.

So even though the OEE change in percentage points was 32%, the actual change in terms of OEE and output growth was 110,3%. When calculating ROI, this is a very big difference and something that company managers and owners must keep in mind.

When using our ROI calculator for OEE software, you should look at your baseline OEE and the increase compared to baseline instead of the change in percentage points.

If, at baseline, you use 10 machines to produce 1 000 products (100pcs/machine), then after an OEE growth of 110,3%, you can produce 2103 products with the existing resources.

Or, to put that into another perspective, you can produce 210,3 pcs/machine after the increase in OEE. In effect, using only 5 machines to reach the same output as previously.

So always look at the big picture when you are tracking OEE and improving your production efficiency because a change in OEE from 45% to 55% can have tremendous effects on your bottom line.

Learn more: How to Calculate OEE – Formulas & Examples

While ROI is a quantifiable metric, other qualitative factors can be considered regarding the benefits of investing in OEE software and production monitoring.

These benefits include:

Other benefits of investing in OEE software include a reduction of paperwork thanks to data automation and time gained thanks to automated reports that simplify production data analysis.

Overall this means that teams can get straight to the business of finding and implementing solutions. But this only scratches the surface.

Learn more: 10 Evocon Benefits for Manufacturers

With our ROI calculator for OEE software and production monitoring, we have presented you with two scenarios to understand and calculate ROI. We have also presented you with several qualitative measures to account for as you consider a potential investment in production monitoring and live OEE tracking.

It is important to remember that each company will be different and that the calculators are conservative in their approach.

For example, while our experience shows that clients can expect an average of 15% OEE improvement, the result can be much higher depending on various factors.