-

Product

-

Use casesIndustries

Evocon supports manufacturers across 15+ industries worldwide. Here are some of the most popular:

-

Resources

-

Learn

Overview of all the features available in Evocon’s OEE software and how to use them.

-

Case Studies

In-depth stories of our users and how Evocon has helped their production.

-

Reports and Tools

Tools to help you gather valuable information in regard to investing or using Evocon.

-

OEE Fundamentals

Basic concepts on what is OEE and guides to implementing it.

-

Increasing Productivity

Tips and guides on how to increase productivity and efficiency.

-

Sustainability in Manufacturing

Reduce the impact of your operations with these helpful articles and guides.

-

The 5-Day Guide to Launch OEE Monitoring in 2026

A day-by-day plan to implement live OEE monitoring.

-

Decoding World-Class OEE

We analyzed the average OEE scores on 3,500+ machines across 50+ countries.

-

Machine Utilization Analysis

Data-driven insights on how machines are utilized and the causes of downtime.

-

6-Month Plan to Reduce Downtime

A step-by-step guide to reduce downtime, based on 10 years of experience.

-

-

About us

-

Partner program

-

Pricing

-

Product

-

Back to main menu

- Product

-

Product Overview

Overview of all the features available in Evocon’s OEE software.

-

Enterprise Package

Advanced features that deliver security, seamless integration, and efficient data management.

-

Integrations

How Evocon integrations with your ERP and other manufacturing systems work.

-

Security

Overview of security related questions and answers about Evocon.

-

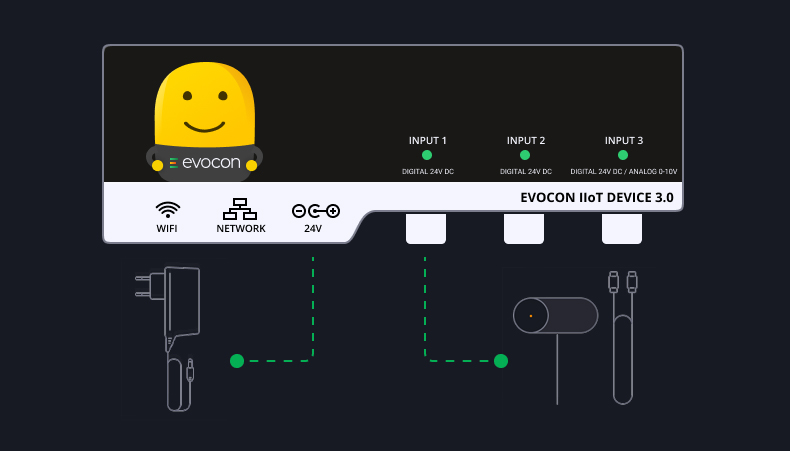

Hardware

Can Evocon monitor your production process?

What hardware do you need? -

FAQ

Can Evocon monitor your production process?

What hardware do you need?

-

-

Use cases

-

Back to main menu

- Use cases

-

OEE Monitoring

Optimize production with real-time and actionable OEE insights.

-

Downtime Tracking

Identify root causes, reduce interruptions, and significantly improve OEE.

-

Manufacturing Data Collection

Automate the capture of production data to drive efficiency and continuous improvement.

-

Production Monitoring

Track performance, analyze manufacturing lines, and optimize operations.

-

Continuous Improvement

Enhance processes, reduce waste, and drive efficiency.

-

Quality Control

Digitize and automate recurring quality checks for more efficient quality control.

IndustriesEvocon supports manufacturers across 15+ industries worldwide. Here are some of the most popular:

-

-

Resources

-

Back to main menu

- Resources

-

Learn

Overview of all the features available in Evocon’s OEE software and how to use them.

-

Back to main menu

-

Resources

- Learn

-

OEE Fundamentals

Basic concepts on what is OEE and guides to implementing it.

-

Increasing Productivity

Tips and guides on how to increase productivity and efficiency.

-

Sustainability in Manufacturing

Reduce the impact of your operations with these helpful articles and guides.

-

-

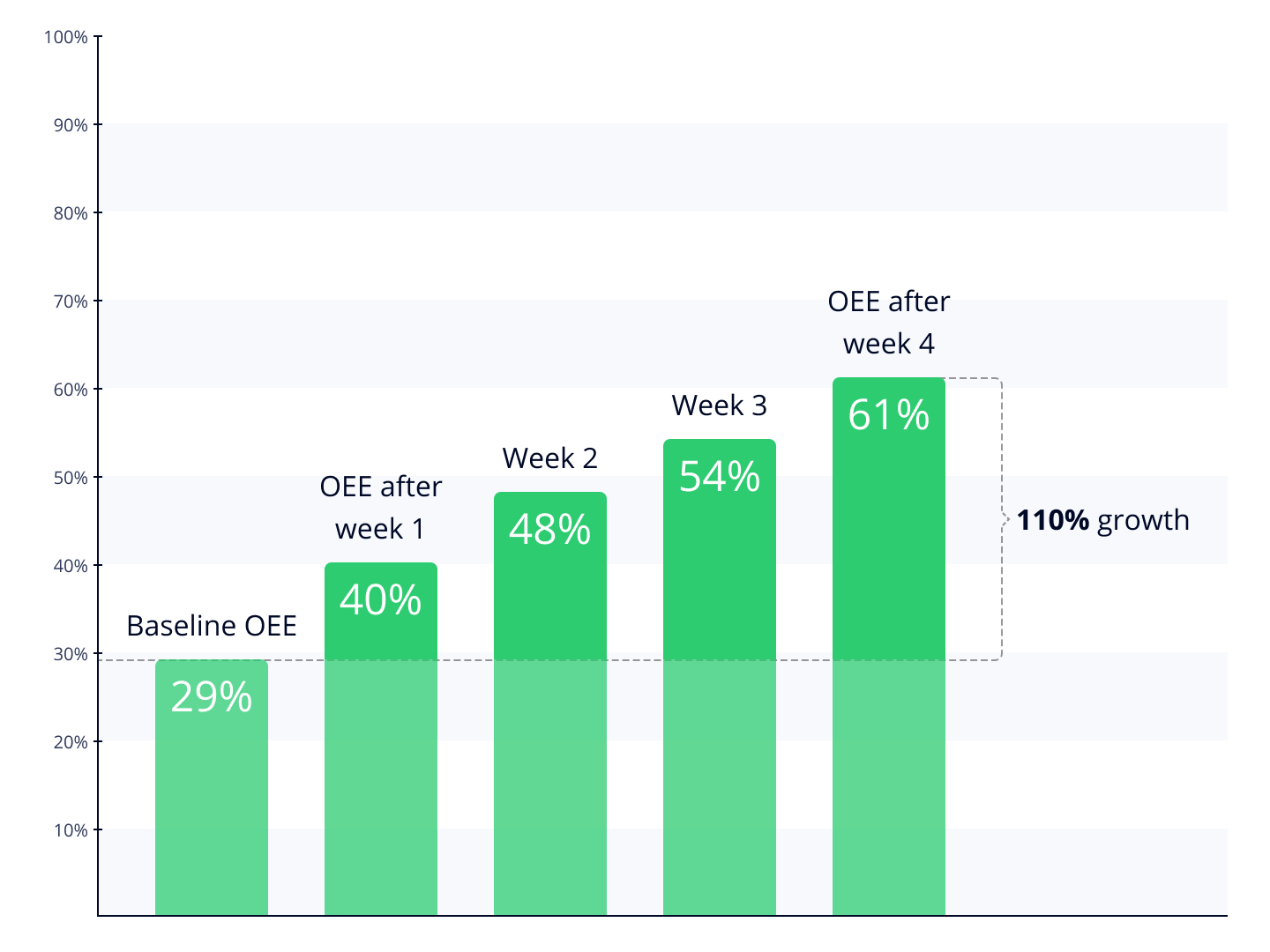

Case Studies

In-depth stories of our users and how Evocon has helped their production.

-

Back to main menu

-

Resources

- Case Studies

-

-

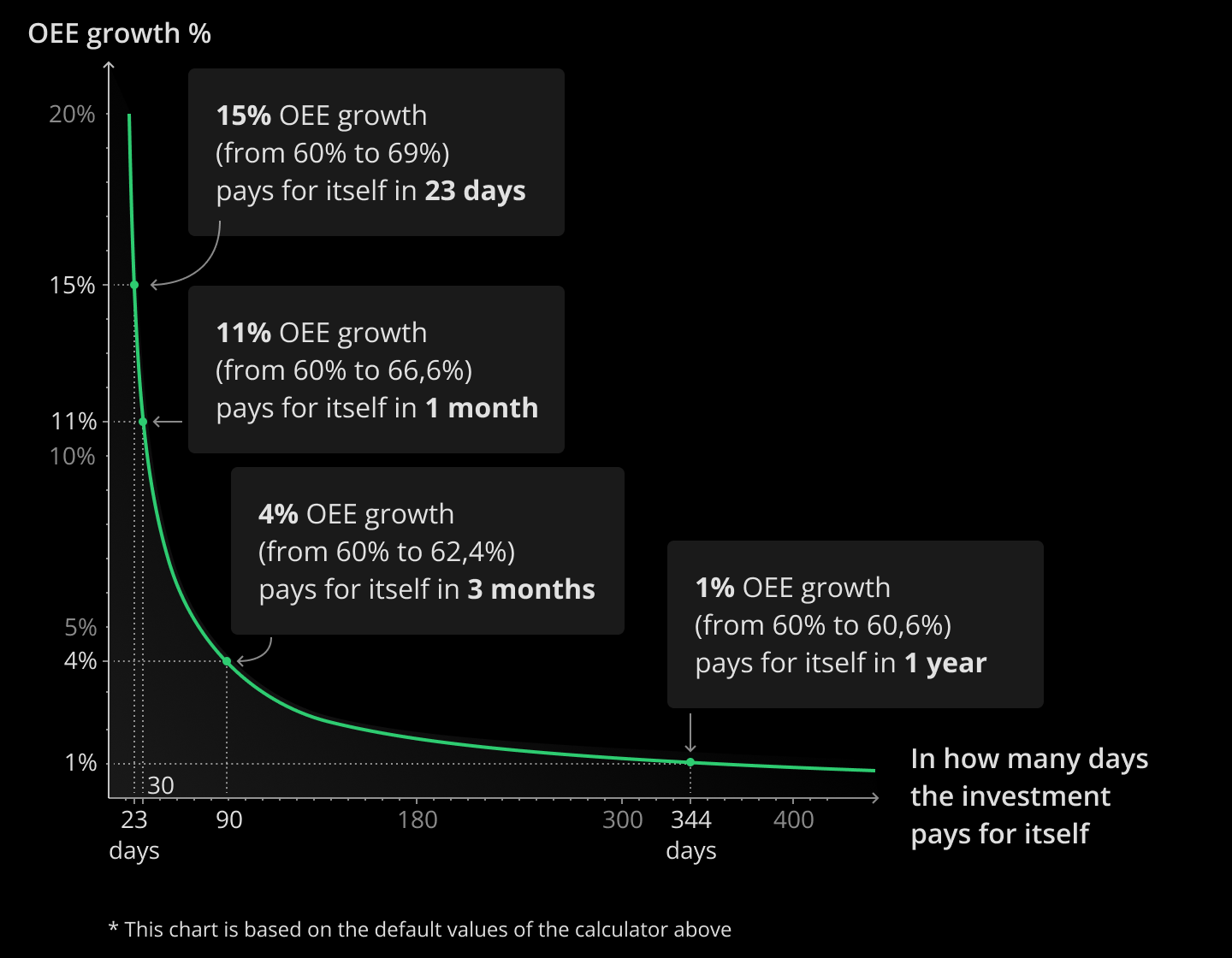

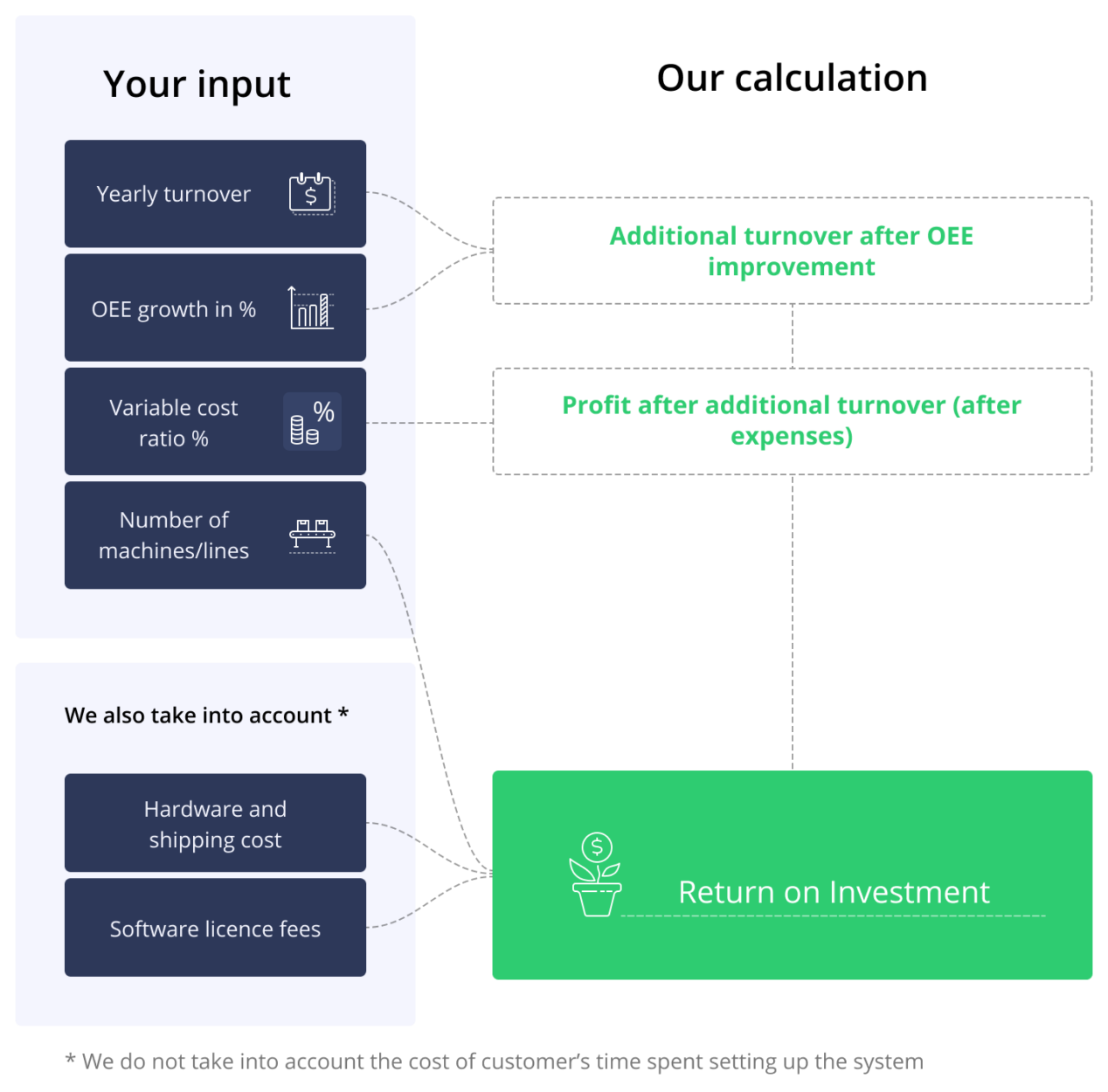

Reports and Tools

Tools to help you gather valuable information in regard to investing or using Evocon.

-

Back to main menu

-

Resources

- Reports and Tools

-

The 5-Day Guide to Launch OEE Monitoring in 2026

A day-by-day plan to implement live OEE monitoring.

-

Decoding World-Class OEE

We analyzed the average OEE scores on 3,500+ machines across 50+ countries.

-

Machine Utilization Analysis

Data-driven insights on how machines are utilized and the causes of downtime.

-

6-Month Plan to Reduce Downtime

A step-by-step guide to reduce downtime, based on 10 years of experience.

-

-

-

About us

-

Back to main menu

- About us

-

Evocon

-

Contact

-

Join us

-

-

Partner program

-

Pricing